With the Online food delivery market at the brink of advancement, Zomato IPO is greeted with a fair share of optimism and caution about the company’s risks. With this IPO opening for subscription on Wednesday, Zomato has become the first Indian food aggregator space Unicorn to be listed on the bourses.

Table of Contents

Source: INDmoney.com

Suggested Read: The Unstoppable Zomato- A Success Story To Watch Out For Sure

Source: Trade Brains

Open date : Jul 14, 2021

Close Date : Jul 16, 2021

Basis of Allotment : Jul 22, 2021

Refund Initiation : Jul 23, 2021

Credit of shares to Demat : Jul 26, 2021

Zomato IPO Listing : Jul 27, 2021

Global coordinators and book running lead managers are Kotak Mahindra Capital Company, Morgan Stanley India Company, and Credit Suisse Securities.

The book running lead managers to the offer are BofA Securities India and Citigroup Global Markets India.

At the first day of the share sale the retail investor part was subscribed approximately 2.90 times.

At the upper end of the ₹72-76 price band, the Zomato IPO attracted retail bids worth Rs 2,655 crore. The segment was reportedly fully subscribed within a few minutes, by the marquee anchor investors that invested ₹4,196 crore on Wednesday. Zomato allocated 552.17 million equity shares, to anchor investors, at a price of ₹76 per share.

Some of the anchor investors include Tiger Global Investment Fund, Blackrock, Fidelity, JPMorgan, Morgan Stanley, T Rowe Price, Canada Pension Plan Investment Board, Government of Singapore, SBI Mutual Fund, Axis Mutual Fund, Kotak Mutual Fund, UTI Mutual Fund, Motilal Oswal AMC, HDFC Mutual Fund, ICICI Prudential Mutual Fund, Tata Mutual Fund, Goldman Sachs India, Abu Dhabi Investment Authority, Franklin Templeton, HSBC Asset Management (India) etc.

Overall subscription was 1.11 times on the first day. Zomato IPO’s issue size of 681.38 million shares received bids for 756.43 million shares. The part of the share sale reserved for non institutional investors was subscribed just 14%, and that for qualified institutional buyers (QIB) was subscribed 1.03 times.

The IPO aims to raise ₹9,375 crore at the top of the price band of ₹72-76.

Many analysts suggest that one should look at metrics like market share and growth profile.

Calculated at Rs 76, Zomato IPO pricing is at 25X EV/sales. The food delivery firm’s global peers like DoorDash etc trade at about 9.6X EV/sales. For Indian QSRs the average is at about11.6X, according to calculations done by Motilal Oswal Financial Services.

An important reason why Zomato IPO is expensive is the scarcity premium – because the market is under-penetrated and growth rate is higher compared to others.

It is a great time for Zomato to go public as there is a rush of investors.

Source: getbasis.co

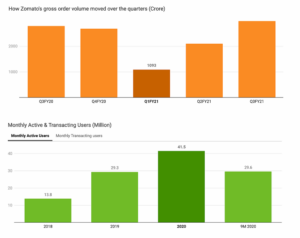

The company, early in FY2021, was severely affected by the pandemic with revenues drying up due to lockdown. But, the fourth quarter was best for the company, it recorded the highest-ever gross orders. The vaccination drives have paved the way for a partial unlocking of the country. As time passes, the country would be looking for a complete unlocking, which will help Zomato’s business. With its huge network and brand image it is well-placed to take advantage of the growing demand for online food delivery.

The global online food delivery services market is expected to grow from $115.07 billion in 2020 to $126.91 billion in 2021 at a compound annual growth rate (CAGR) of 10.3%. The growth is due to the companies resuming their operations and adapting to the new normal while recovering from the COVID-19, which had earlier led to restrictions and measures involving social distancing, remote working, and the closure of commercial activities that resulted in challenges. The global online food delivery services market is expected to reach $192.16 billion in 2025 at a CAGR of 11%.

The rise in smartphones has boosted online food delivery platforms. These users are the main online consumers for the Food industry and an increase in smartphone users points to an increase in online demand for food. The world F&B (food and beverage) e-commerce users reached 1.5 billion in 2019 and are expected to grow by 800 million, with an average of 25% year-on-year growth, by 2024. Zomato, has about 80 million monthly active users and targets to reach another 20 million over the next few years. Increase in smartphone users leads to internet penetration, which is driving growth in the online food delivery industry.

Harness this growth in the Online Food Delivery Industry and manifest your ideas. Code Brew Labs has helped over 9 Multi-Million dollar food startups, and is trusted by 1350+ restaurant owners Worldwide.

Have a Zomato like App idea ?

Fire Up Your Business, by clicking on the link here.

Want to know How Does Zomato Work & Makes Money? Check out this video: